The Ultimate Guide to Day Trading in Forex

Day trading in forex involves buying and selling currency pairs within a single trading day, aiming to capitalize on small price fluctuations. Traders employ a variety of strategies and techniques to make informed decisions swiftly. For those new to forex, it is essential to understand the dynamics of the market and have access to quality information and reliable trading platforms. If you’re starting your forex journey, check out day trading in forex Best Cambodian Brokers to find the right support and resources.

Understanding Forex Market Characteristics

The forex market operates 24 hours a day, allowing traders to execute trades according to their schedules. This constant operation leads to high volatility, which is advantageous for day traders seeking quick profits. Key characteristics influencing the forex market include:

- Liquidity: The forex market boasts high liquidity, meaning that large amounts of currency can be bought and sold without significantly impacting the price.

- Leverage: Many brokers offer significant leverage, allowing traders to control larger positions with a smaller amount of capital, which can amplify both gains and losses.

- Market hours: The forex market is divided into four main trading sessions — Sydney, Tokyo, London, and New York — enabling traders to capitalize on global economic events and market news.

Day Trading Strategies for Forex

Successful day traders often develop specific strategies tailored to their trading styles and market conditions. Here are some popular strategies used in forex day trading:

1. Scalping

Scalping is a strategy that involves making a large number of small trades throughout the day, aiming to capture tiny price movements. Traders who engage in scalping often close positions within minutes or even seconds, relying on quick execution and tight spreads.

2. Trend Following

This strategy revolves around identifying and following existing trends in the market. Traders use various tools and indicators, such as moving averages and the Relative Strength Index (RSI), to determine entry and exit points that align with the overall market movement.

3. Range Trading

Range trading entails identifying price zones where a currency pair is trading consistently within a particular range. Traders buy at the lower end of the range and sell at the upper end, utilizing support and resistance levels to inform their decisions.

Essential Tools for Day Trading

To be successful in day trading, traders should equip themselves with a suite of tools and resources that can help optimize their strategies:

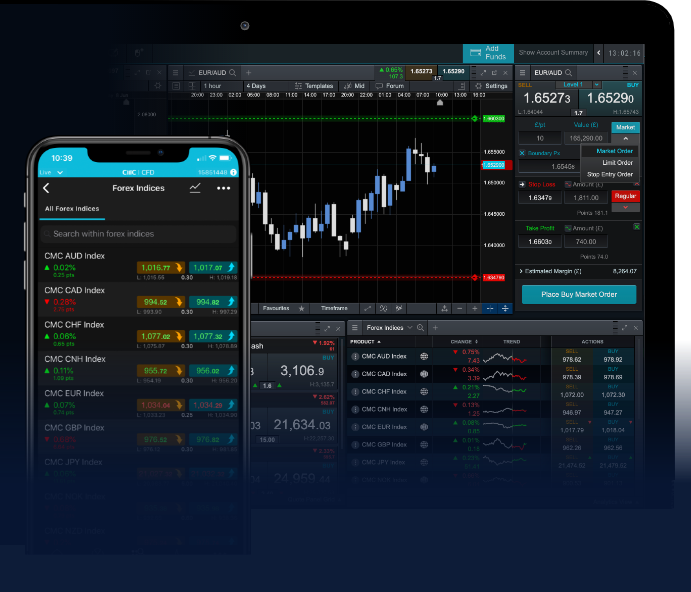

- Trading Platform: A robust trading platform is critical for executing trades swiftly and analyzing charts. Look for platforms that offer advanced charting tools, technical indicators, and customizable interfaces.

- Economic Calendar: Keeping an eye on economic announcements and events is crucial, as they can significantly impact currency values. Use an economic calendar to stay informed about upcoming releases.

- Technical Analysis Tools: Familiarize yourself with various technical indicators like Moving Averages, MACD, Bollinger Bands, and Fibonacci retracement levels to analyze market trends and forecast potential price movements.

Risk Management in Day Trading

Day trading can be highly rewarding, but it also comes with substantial risks. Implementing effective risk management strategies is critical for long-term success. Consider the following practices:

- Setting Stop-Loss Orders: Always use stop-loss orders to limit potential losses on each trade. This automated tool exits your position once it reaches a predetermined price point, helping to preserve capital.

- Position Sizing: Determine the appropriate size of each trade based on your overall risk tolerance and the capital you have available. It’s typically recommended to risk no more than 1-2% of your trading capital on a single trade.

- Reviewing Performance: Regularly review your trades to identify patterns, successes, and areas for improvement. Maintaining a trading journal can help track your decisions and outcomes, enabling you to refine your strategies.

Psychological Aspects of Day Trading

The psychological aspect of trading is often overlooked, yet it plays a significant role in a trader’s success. Developing a trading mindset requires discipline, emotional control, and the ability to remain calm under pressure. Here are some key elements to consider:

- Emotional Discipline: Day trading can evoke strong emotions such as fear and greed. Establishing a solid trading plan and sticking to it can help maintain discipline even during volatile market conditions.

- Avoiding Overtrading: It can be tempting to place multiple trades in quick succession, but overtrading can lead to poor decision-making and increased transaction costs. Set strict criteria for entering and exiting trades to avoid unnecessary trades.

- Accepting Losses: No trader is immune to losses. Accepting that losses are part of the trading journey and managing your mindset toward them can help you remain focused on your long-term goals.

Conclusion

Day trading in forex offers exciting opportunities for those willing to learn and develop the necessary skills. By understanding market characteristics, employing effective strategies, utilizing essential tools, managing risks appropriately, and maintaining psychological discipline, traders can enhance their chances of success. Always remember that continuous learning and adaptation are crucial in the ever-changing forex landscape. Whether you are just starting or seeking to refine your approach, keeping up with market trends and practices will help you navigate the complexities of day trading effectively.